|

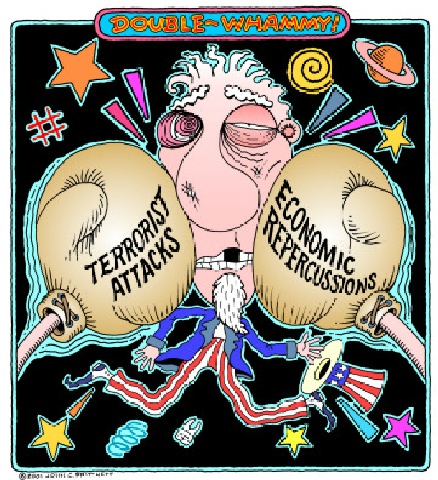

GROUND ZERO, New York City, October 14 -- Terrorism has many hungers. One of them includes eating holes in a person's assets. War, or the threat of it, historically shifts the investment world downward as the economy moves from stability to instability.

That's why investment planners are

calling for "terror-proofing" or "war-proofing" investment portfolios,

shifting the investments so that a war against Terrorism won't gnaw holes

in the sack of gold one has accumulated over the years.

Wise investors put

on their bullet-proof vests in times of war, and circle their "economic

children" to protect them from the ravages of war. They become

Fathers and Mothers of Vigilance regarding their "investment children,"

looking out for them as they might a human child, sheltering them from the

storms so they won't be maimed or crippled, or suffer the worst of

all--losses instead of gains.

People forget "Financial Terrorism" is the root of much discontent. Poor financial management puts millions of families at risk. It deprives families of "economic security," and robs the family coffers of assets to invest in a child's education, in a better place to live, in better food, and fewer battles and turmoil over the lack of it. Financial miss-management in families creates "Terrorism under the roof," where parents become embittered over being in constant debt, and arguments rail over what one doesn't have. The child, deprived of many things, becomes what he is taught by association--a money abuser. He or she never learns to respect it, for he or she has no model, not understanding that money is the fruit of one's labor, and that it is to be protected so it can offer the children a better way of life.

Anti-money advocates have

no respect for it because they don't realize the importance it offers in

securing a family's stability. They forget it takes over

$200,000 to raise a child in America in a life of middle-class security.

They forget that to achieve that goal, one must invest wisely, and grow

the "monetary children" along with the human ones, or, suffer the

Terrorism of constant debt, and constant worry over where the next dollar

is coming from.

Launched on August 10, 1971,

PAX World Funds was launched as a means of investing in "ethical

companies," ones that didn't reap its profits from defense, weapons,

gambling, liquor, tobacco, and nuclear power. (In the 1920's these

were called "sin companies.") PAX uses

both social and ethical screens to keep its portfolio clear of companies

considered "undesirable." It invests in companies that provide

goods and services that improve the quality of life. Their

primary focus is health care, housing, technology, pollution control,

utilities and education. Terrorism is causing America and the world to look deeply into their own pockets--at both the financial cost of war, and the ethical and social costs as well. We are debating war's nature. Terrorism is forcing every nation to realize its fragility and its insecurities.

The bombing in

Bali--the ultimate paradise in many people's imagination--is now a place

of Terror, complete with its own Ground Zero strewn with the blood of

innocent people who became victims overnight. Many who died in Bali

are similar to many who died on Nine Eleven--they weren't financially

secure. Their families suffer the economic brunt of losing the

security of a provider. I grew up in "Economic

Terror." My parents fought over money almost daily. I

grew to hate money because it was the "enemy of love," always seeming to

upstage the discussions of what we were going to do, and what we couldn't

do. I had no training in how to "respect money," and have

suffered my own way through years of bad financial habits--i.e., not

investing, not caring for the "financial" children of my labors.

But today, this moment, there

is a need for all who have accumulated wealth to protect their family's

security to take a second look at its security. It is time for

those Parents of Vigilance, Citizens of Vigilance and Loved One's of

Vigilance to examine ways to shield their "financial children" from loss

should the war on Terrorism escalate, and put at risk the family's safety

net.

And, to teach children to respect money, not to abhor it, or waste it so that it becomes more important than love. There is balance. It needs to be sought.

Oct 13--"A Psalm Of Vigilance"

|